Introduction: Start Small, Grow Big

Think investing is only for the wealthy? Think again.

With just ₹500 a month, you can start your investment journey and build long-term wealth. Whether you’re a student, a working professional, or a homemaker, SIP (Systematic Investment Plan) makes investing affordable, simple, and effective even if you have zero knowledge about the stock market.

In this blog, you’ll learn how to start SIP with ₹500, the benefits, best SIP plans, common mistakes, and how to grow your wealth gradually. And if you’re also interested in personal finance and business growth, check out our related blog on Top 10 Business Strategy Books for 2025 to boost your money mindset.

What Is SIP (Systematic Investment Plan)?

A Systematic Investment Plan (SIP) is a method where you invest a fixed amount regularly usually every month into a mutual fund.

It’s similar to a recurring deposit (RD), but instead of a bank, your money is invested in mutual fund schemes managed by professional fund managers. These managers invest your money in equity (stocks), debt (bonds), or hybrid options based on the fund’s objective.

Why Is SIP a Smart Investment Choice?

- No need to time the market

- No large amount required upfront

- Reduces emotional decision-making

- Perfect for salaried or first-time investors

Even with ₹500 per month, you can take advantage of compounding, market volatility, and long-term capital growth.

Can You Really Start SIP with ₹500?

Yes, absolutely.

Many AMCs (Asset Management Companies) in India allow investors to begin a SIP with just ₹500/month. This has made investing more accessible to:

- Students

- Young working professionals

- Middle-class families

- Homemakers

Myth busted: Investing is NOT only for people with thousands to spare. Even ₹500 can be the first step toward wealth creation.

What matters most in investing is not how much you invest, but how consistently you do it.

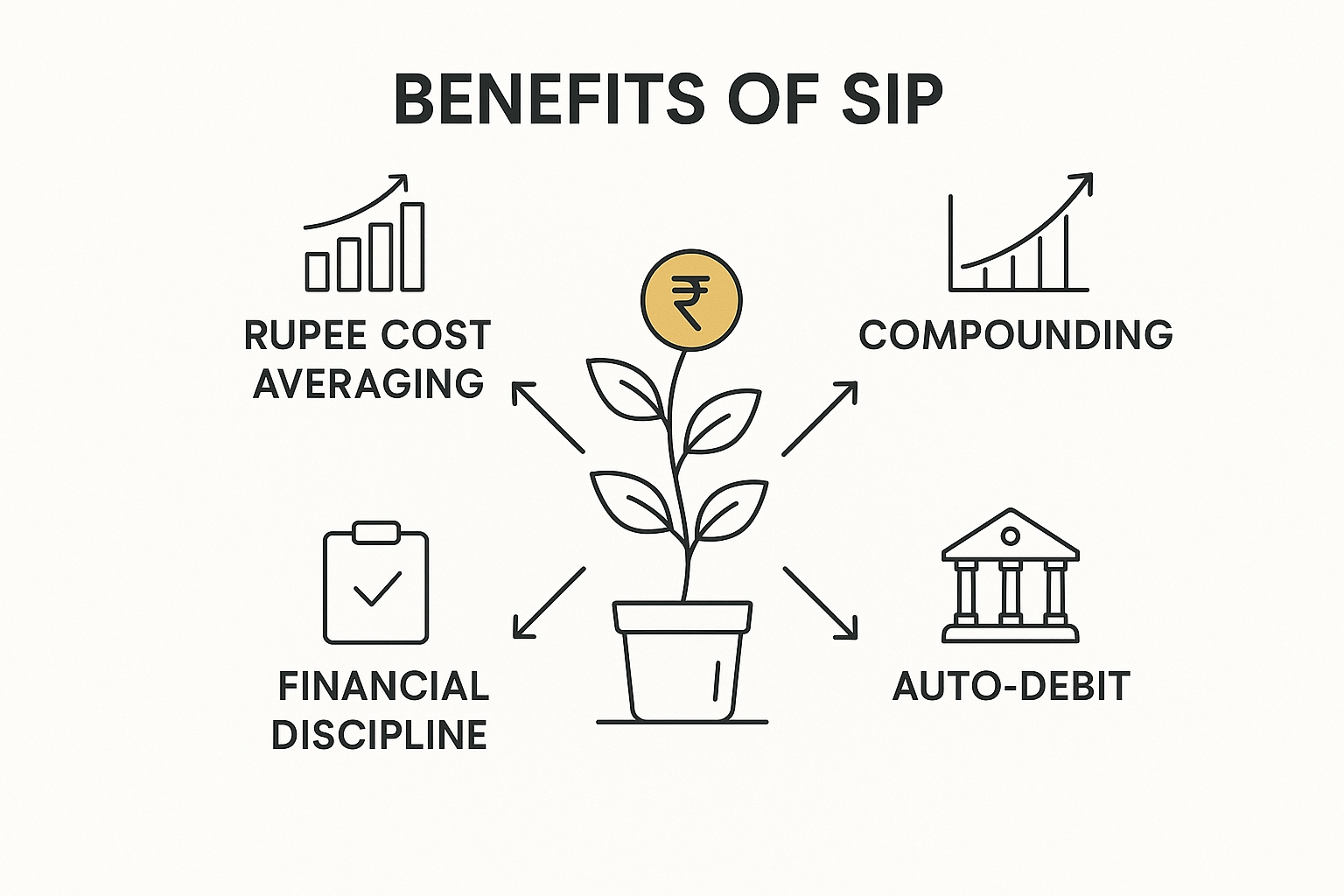

🎯 Key Benefits of Starting SIP Early (Even with ₹500)

1. Rupee Cost Averaging

SIP allows you to buy more units when the market is down and fewer when it’s up. Over time, this averages out the cost of your investments and reducing your risk.

2. Power of Compounding

Let’s say you invest ₹500/month for 20 years with an expected return of 10% you’ll end up with ₹2.8 Lakhs even though you invested only ₹1.2 Lakhs.

Small amounts + Time = Big Money

3. Financial Discipline

You build a habit of saving and investing regularly, which helps in achieving long-term goals like buying a house, travelling, or early retirement.

4. Auto-Debit = Hassle-Free

Once set, SIP gets deducted automatically from your bank account, so you don’t miss any month.

📊 Best SIP Plans to Start with ₹500 in 2025

Here are some beginner-friendly mutual fund options that allow SIPs starting from ₹500:

| Fund Name | Category | Risk | Avg. Return (5 yrs) | Min SIP |

| Axis Bluechip Fund | Equity – Large Cap | Moderate | ~11% | ₹500 |

| Parag Parikh Flexi Cap Fund | Flexi Cap | Moderate | ~15% | ₹500 |

| HDFC Hybrid Equity Fund | Hybrid | Moderate | ~12% | ₹500 |

| Nippon India Small Cap Fund | Equity – Small Cap | High | ~17% | ₹500 |

Note: Returns are market-linked. Always review fund factsheets, ratings, and consult an advisor if needed.

How to Start SIP with ₹500 Online – Step-by-Step Guide

Here’s how to start investing right from your smartphone or laptop:

✅ Step 1: Choose an Investment Platform

Popular SIP platforms in India:

✅ Step 2: Complete Your KYC

KYC is mandatory. You’ll need:

- Aadhaar card

- PAN card

- Selfie or live photo verification

✅ Step 3: Browse and Select Mutual Fund

For beginners, Axis Bluechip Fund or HDFC Hybrid Fund are good places to start.

✅ Step 4: Set SIP Amount and Date

- Choose ₹500/month

- Pick a preferred debit date (e.g., 5th or 10th of every month)

✅ Step 5: Enable Auto-Debit

- Link your bank account or use UPI

- SIP will automatically deduct every month

🎉 Done! You’re now an investor 💼📈

📈 How Much Return Can You Expect with ₹500 SIP?

Here’s a simple return estimate using 10% average annual returns:

| Monthly SIP | Tenure | Total Invested | Final Amount |

| ₹500 | 10 years | ₹60,000 | ₹1,03,722 |

| ₹500 | 20 years | ₹1,20,000 | ₹3,81,865 |

📌 Use online SIP calculators to plan your future goals.

💡 Pro Tip:

If your income increases, use the SIP Step-Up feature to increase your SIP annually by 10–20%.

🔍 SIP vs Lump Sum: Which is Better for ₹500?

| SIP | Lump Sum |

| Ideal for monthly investments | Requires big amount upfront |

| Reduces risk via rupee cost averaging | High exposure to market timing |

| Great for salaried or new investors | Suitable for bonuses or windfalls |

✅ Verdict: For beginners and ₹500/month, SIP is safer and more sustainable.

⚠️ Mistakes to Avoid While Starting SIP

Even with a small SIP like ₹500, avoid these beginner traps:

- ❌ Stopping SIP during market dips – Markets will bounce back; stay invested

- ❌ Choosing funds randomly – Select based on goals and risk profile

- ❌ Skipping SIP payments – Leads to missed returns

- ❌ Ignoring annual performance review – Check returns, ratings, and adjust if needed

❓ FAQs:

Q: Can I increase my SIP amount later?

Yes, anytime. Most platforms offer easy modifications.

Q: What if I miss a SIP?

Usually, there’s no penalty. But try to maintain regularity for better returns.

Q: Is ₹500 enough to start investing?

Absolutely. It’s better to start small than wait forever. Start now, grow gradually.

Q: Is SIP safe?

SIP is not risk-free since it’s market-linked, but it reduces volatility when invested long-term.

📚 Bonus Read: Want to Learn More About Business Strategy?

If you’re serious about managing your money smartly, you’ll also love this:

👉 Top 10 Business Strategy Books Every Entrepreneur Should Read in 2025

These books can change how you think about money, investing, and business growth.

🏁 Conclusion: Start Today, Thank Yourself Tomorrow

Starting a SIP with just ₹500 is not only possible, but one of the smartest money moves you can make today. It’s easy, automatic, low-risk, and builds discipline. Over time, this small habit can create massive financial stability and freedom.

🌱 “Don’t wait to invest. Invest and wait.”So what are you waiting for?

Download an app, pick a fund, and start your SIP with ₹500 today. One day, you’ll look back and be glad you did.